Thank you, appreciate it. Although discrepancy on one wallet would still be 14M points comapred to 20M which is -30% but if you looked into all those pools again it might be due to the reset price rule, thanks for the help, also any chance I could get more pools double checked in the future if I can provide reasonable suspicion that they have been incorrectly flagged?

That pengu/SOL pool looks fine.

-

Were fees from M3M3 pools excluded or counted differently

Fees from m3m3 pools were excluded because the trading fees went to the stakers, and not the liquidity provider. Were you staking in the pool or LPing the token separately?

-

Is my Season 1 points allocation correct given my contribution?

Unless you have specific pools to report, it looks fine

@soju Could you please check this issue? I’ve noticed that some of my wallet’s fees on Kamino were not accounted for—only the TVL score was included. There might be some oversight here?

Appeals have been updated but missed pools have not been updated.

Full update tomorrow.

Hello many you guys know me from LP Army and I already talked with @soju in private but I will appeal here so everyone can see how this airdrop distribution is unfair

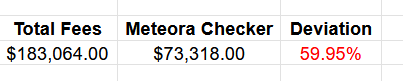

I Farmed 183K fees across this multiple months and my Meteora airdrop shows 73K with the deviation almost 60%, I haven’t used any 3rd party program to check my fees and I went to each pool individually: Here it is the full list: Spiderman.sol - Google Sheets

The system that Soju chose “Allium’s Closing Price” is flawed

The system is flawed because it completely ignores what happens after the token launches, especially for low market cap (200K–300K) memecoins — the exact tokens that generate high fee volumes and attract early LPs and users.

Despite all this, if the closing price at 00:00 UTC is near zero, the token earns zero or near zero graduation points because the system only sees the final candle.

TLDR:

I) Unfairly penalizes users and LPs who took the risk of investing in low market cap tokens that later rugged.

II) Artificially Score Metrics: Relying on just on candle final price at 00:00 UTC means traders can manipulate that price especially on low liquidity markets.

My Solution for this:

Track token price movement for 30–60 minutes post-launch and use the average price instead of the daily closing price.

I know I’m not the only one affected by this and I hope more people come forward so Meteora team can fix this.

Hello!

The following pool was not credited to me: A88M5XvXczwL4TmNuTxvkwWNoyaeXZAMevbmSnU5uV8x.

It appears on the blacklist, although there is no valid evidence of any violation. Based on the farming rules provided, I believe this pool was mistakenly flagged. Please find my detailed analysis below.

1. Holder Distribution

Token distribution complies with the stated criteria.

The top 2 holders own less than 98% and the top 5 holders own less than 95% of supply.

Total unique holders > 100.

Token has no freeze authority and was not created by the position owner.

2. Real Trading Activity (No Wash Trading)

The pool had unique swaps through Jupiter (well above the required 10 swaps/day).

Trading involved multiple unique counterparties — not a small cluster of addresses.

3. Liquidity and Volume

TVL consistently exceeded $500 during the farming period.

Total trading volume exceeded $ USD, which was achieved organically and not via artificial self-trading.

Supporting transaction data: [Solscan TVL/Volume link] https://solscan.io/account/A88M5XvXczwL4TmNuTxvkwWNoyaeXZAMevbmSnU5uV8x?exclude_amount_zero=true&flow=in&remove_spam=true&value=50&value=&page_size=20#transfers

4. RugCheck Verification : PASS Token verification: https://rugcheck.xyz/tokens/wq1dybujM4AiF3skagm9283iTHE5GBUqGN4Thj326Ba

Conclusion Based on the above evidence, this pool meets all farming requirements and does not match the criteria for either wallet-based or pool-based blacklisting. I kindly request that the pool A88M5XvXczwL4TmNuTxvkwWNoyaeXZAMevbmSnU5uV8x be whitelisted and credited in the points system for fees.

Don’t understand how it makes sense to use the model they used when majority of the tokens don’t last. I am 100% with this proposal. I am at a 30% haricut along with a large audience of others who provide LP to coins that don’t last more than a few hours at best.

MET makes money off these pools, there is no daily candle close cut off, but there is for those that drove the volume through the pools to begin with? Come on @soju! It doesn’t make sense.

I and our audience were staking in the pool on the M3M3 platform until it got rekt. My question is: will there be any kind of compensation for the participants?

I do have pools! Also, you haven’t answered why my points are being calculated disproportionately.

Here are the pools I participated in:

6XMrsTeFC8gYmVasKaBuVwU4fyAVPJLHd8jno82JBhS5

AEHB6udTR3nGaYmo3hCuAnHuMWUNbsH5ygxtJcRoWwgT

4CTUHtiHrPHFT4Zc1qNScrposmM7xfupU7EVDWCR7PZw

DUB4Wd6ZA2f6ePwDghiPpfWf7Z2eQtqnuaPpPdD6Ebw1

CMrCLFbu8kviKxJozcH4TAnKQpcqCSTqVYnESHJSuRib

5pX7w2UExVUnLB9BrLSiYvceFtJTrCLjSPocMGgB2hFE

8cFCm7JnaSAncWjDb84zBCQ1YdkTqLfVaMzd3rMCUUaT

ArRY3b2Rsy2GQAkoD9515sJttgZRXuMX5NeHXZ5bqFGd

HFPb1SLCmQpKefJBUKHmZUgxGbjATgwxxuaz5QthosJz

4pMPkrwbicEey3FzQTB8hgHwgo2KkB3BoJWGztvqT2kt

49E6mXSuREn8vxN7zbtsrrmiMLbP6GxpnTEN59U6tdXg

89tt7wiceXTkfdf23JP9D6xajc6U3xR2bkN7QvB8Xkwn

6gerq42CgUByPXbgxzBwWrvg4TVLkW1AGi5BQwpgEvq8

JBb2TRyjNbeLvHQ1NSkJ33JQXbqqcy1YJaYZsW4UiuXf

mfnfdNVVhJpaosyHjJEdoehuqvvUTuBEpx7up35tRKd

3z9bMq4AWa44GmLK6EzVU3jxnPm464vKmEAJNsgqpdRs

2BdqhjXUmv26PeGrmwPJJyKt5ufJc4HrXDxV8G2TMbuq

73sWxVfZD5fWcMLgBN7L7ppx197qbGS5Si1fEajzE5AL

KMDPgiXNFHpzJpvHLN1mqJo4LwbunjY9r3LE2wYW2vV

EfFkuWjqcaHBxjjzR6QkrncfUfYhqYZ6PWwK8w6oVXyt

EiNKZXbGWdMiw7APWz8g3kzGDiK2ZeMSyF62wRPTiSqw

ABvUnk3MVyYKV74gtcFM5R5hrKSRguPDqPHgjZP4DnCL

H1PLrbuUwk2UWk9J49ZJtrDsnjfSqJ8mQE7cauFqkEWz

4FL43x2QRGmt8pSjD1YERwMv7gfT2DQwby5yikvVi23X

7azEMGaTTWEXW5EAfSmMmSoaREYaWToifebdvMY24wXd

2T62gq1Kbhp8U4gEdxjccdCbC1x2Sy7pWVauX7xKMnZe

F6MRPHvrF38EAmYFFemtxaeoYdSZRW7UApAV1Mpgykd6

8DaNTPqt2iRPu6SdHVCmraZUD1BBh4N9PtyWEkZDTmom

EouEFJ7LP1HcxFaXMeBQAmXqcTmAwxtPZvAALGguVkxk

HM6u234oHXheruteXVfCxKfZboKVih5pnPJ2zf5FKMW5

5yBQNfq4GxXdiechBYnaQLUs2Xern9vF3KALyyU8mdq9

5BDuFW8a3JQk3oNHqTbJFE2CQVfTeXsGc48fR62mUH1x

nWrt7PWy7y3mcEPi6jWiLnCmb3kwxKPrJjkM7fQqfAY

62ypLB77qeCwsccN15GbvXdCDgUdwc76JzvLdfnef9VB

6qFVNTiiBf1GXJ55kMVh3KNy5rm5CgmxdUcWdGBDBhPt

5crviR9KAfFqSREj5NqgYwXTwAPS2th4CHBev96s8q2t

FNa3xWCpg3Z21WK1UMrnyWpRzLHFbCHYxex8mzaWhn34

HBCCLnrpsAuyqxytc5EHMxDKa6twQ1vs9nS9m4ukW93s

4qKH58ciLbe1U5ULkq5TQ9TWPFtqkrxdciBWbvuBqPPs

what?! no!!! just seeing this, this makes no sense, not every token is a 100mil runner and the ones that print max fees are lowcaps which are attractive to lpers with a smaller portfolio as they can earn max fees on the high volume before the tvl gets too saturated for them essentially taking on that risk early on which earns them more points, the meteora point system was supposedly based on 1000pts for 1$ fees earned, not total value of fees at the closing day candle, many high volume tokens go to zero daily, yet lpers print max fees on them through dlmm, taking away their points based on closing day candle is not fair.

@Soju Hope you listening to your community people that are replying on my post are from LP Army responsible for 80% of the pools open on Meteora.

People who farm low market cap tokens should be rewarded not penalized they are boosting your platform.

They take the risk up front, they often lose money in rugs or failed launches and then the system ignores their contribution entirely just because the token didn’t survive until 00:00 UTC.

I 100% agree with this proposal. It would absolutely make things far more fair on most utility and retail users … the majority of the ones on MET and not people simply farming.

Good call and well done.

Yeah!

”Daily Candles Closing Price” is an error, it’ll get just the prices exactly at 0 UTC.

So if someone did trenches on low mcap tokens just around 0 UTC, he is miles away from someone who did it like 12 UTC, because the low mcaps die in 1-2h, it depends.

The person who did trenches at 12 UTC… his fees will be 90% less countable for points, which is how much most low mcaps lose in value. Sometimes even more.

And if someone focused just on low mcaps, which was the way people could farm the most fees to compete against whales, he risked more money losing than whales who just keep their money in large caps. ;x

Sadly, this system does not honour your most loyal trenches soldiers, the LP Army low mcap degens!

Get 1h candle prices instead. It would be better! The solution is simple. You would just need to run your points algorithm again. It’s a pre-loaded points system, as I understand it, right? Just pre-load it again with these 1-hour candles instead and it would be better. It will take longer, but we still have time for this!

Take this as feedback on the points system. It’s good, but it can be improved this way.

I agree that it would be unfair to those of LP low cap tokens and changing the rule on how to calculate points near the end of the run —IMO and respectfully— is crazy. The protocol earn fees on those shitcoins as well but the one who took the risk providing liquidity on those shitcoins will be punished at the end of the day?

I also have -30% deviation on my total earn fees vs their calculation method.

imo the main equation should be kept as simple as possible; 1. Time, on both planets,

2.Effort/Believe, invested in both ![]() ,

,

3. Energy/Money volume entrusted.

4. Strict wallets validation

On point, well said.

The vast majority of daily pools are on tokens that fit this profile. Meteora’s usage, thrives from these types of tokens, and a great part of its daily users provide liquidity on these types of tokens. It is not fair for lp army members to get heavily penalized for it just because a certain price calculation method has been set that actually does not fit at all with the memecoin market conditions and timeframes.

Meteora is the go to platform to dlmm memecoins, therefore it just does not make much sense, lets hope this can be taken into serious consideration,

We’ve just completed our second round of updates.

Note that this would be the last update before Airdrop Checker + TGE, but we will do another round of verifications and approvals before TGE.

If you have any problems with your points or submit a new appeal for your wallet, you might need to wait for Airdrop Checker to any updates.

Quick Summary of Updates

-

Multi-Token Pools were excluded due to low TVL, and complexity to read on-chain.

-

Kamino’s 2x multiplier earlier promised in article was removed, alongside the removal of all other multipliers

-

We went through all the comments here to verify that no pools were incorrectly blacklisted, and identified a total of 10 pools. All 10 pools have now been whitelisted.

-

A single pool that was used by the TRUMP Deployer was incorrectly marked as a Retail Pool, it has now been updated as a Launch Pool.

Multi-Token Pools

Integrating the Multi-Token Pools proved to be significantly more difficult than regular pools.

As these pools had quite low TVL + quite little users using it, we’ve made the decision to drop multi-token pools from the points system.

I understand that this might affect a small group of people, please reach out to us on Discord and tag myself (0xSoju) if it does affect you.

3rd Party Platforms: Kamino Multipliers & Exponent

Earlier on, during the Amendments to LP Stimulus Proposal, we proposed the removal of all multipliers. In line with this, Kamino’s 2x Multiplier has also been removed.

Additionally, Exponent points have now been added to your dashboard. If you had used Exponent, you should be able to see the points.

Appendix: Pools Modified

| Address | Type |

|---|---|

| A88M5XvXczwL4TmNuTxvkwWNoyaeXZAMevbmSnU5uV8x | Added to Points |

| 4CTUHtiHrPHFT4Zc1qNScrposmM7xfupU7EVDWCR7PZw | Added to Points |

| 3ezfzf2e43R7YMroonphEhqGcujkn2FYeNAbNKobJJAQ | Added to Points |

| 3wGWY1GuCjpWGUYCqjbA3SHmUrFggV3VjgEwTfYEG8RJ | Added to Points |

| 4LeN8J2gUb7uz2PU7h7KoWAPAgmWwBJ75tV6KjBinWta | Added to Points |

| 4xsze49WxTcDAV2vyiMfMYE6X7i57A2iYQaeVB6Au9Sg | Added to Points |

| 68s4QKdGfH8X7bsk3BGZoTDzufHmo3AHqYc2RhLfwBo7 | Added to Points |

| 8nhBuEMHmbMW6LhYFHmSjzmLBvtTe3hVyuLYxjvvntFp | Added to Points |

| BrDqVLTnFf8L9aL5czPZGynFjuVvCU5hsUyxMFYNQ3ab | Added to Points |

| DVFyVS13TM7tmeXPmaWEmQGZCQ8Hqq7qBEMVWrpLkim5 | Added to Points |

| 7XCtQNnsTX3aGKrMjPvaRxJn8YKWvEkqioNZ5k4yrqud | Added to Points |

| 9d9mb8kooFfaD3SctgZtkxQypkshx6ezhbKio89ixyy2 | Launch Pool |

why soldecoder have flagged my wallet, i just used this app on meteora wallet.

Wow this seems crazy to me…!

So we take on the risk of getting rekt on low mcap to earn fees which Met takes a % off… we either profit or lose… Met always wins… token goes to zero and we lose the points on that?

Maybe Meteora repays the fees they took based on daily candle closure if token went to 0 then…?

Not to mention that we also paying pool and bin creation fees on these which go to Meteora I assume?

Absolutely agree with this post. It’s very disappointing to see Meteora using a closing price method that clearly fails to reflect the reality of how new launches trade — especially in low cap, high-risk environments where LPs like us are taking on the most risk to support the ecosystem.

The fact that loyal, early liquidity providers are being penalized because the system only looks at the 00:00 UTC candle is not just unfair — it’s deeply frustrating. It completely ignores the high volume and activity that happens immediately post-launch, which Meteora earns a lot of fees from.

We’ve supported Meteora through volatile and risky environments and I sincerely hope Soju and the team re-evaluate this system and adopt a more accurate, fair method — such as using the average price in the 30–60 minutes post-launch window, as suggested.

This needs to be addressed.