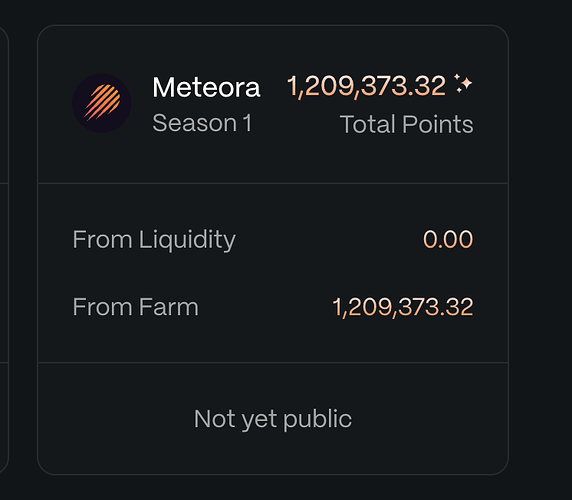

I’d like to kindly request a review and recalculation of my Meteora points, as the total I received seems significantly lower than expected based on my activity.

Here are the key details:

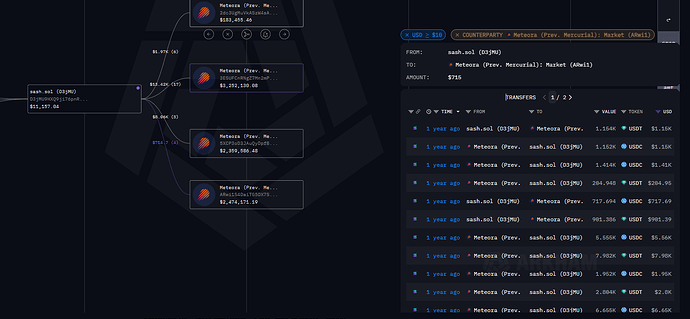

– Wallet address: D3jMU9HXQ9ji76pnR4vfBjtv7DeAq7rrWt54AayRQBrt

- Date: Early 2024 (could be late 2023)

-Pools: One of the first pool I believe was the UXD-USDC-USDT multi token pool, I probably switched later on for other stable pools).

– TVL: I averagely held over 50,000 USD of TVL in one of the DAMM V1 pools (stable pools)

– Duration: 365 days — I’ve been providing liquidity throughout the year without withdrawing or making major changes.

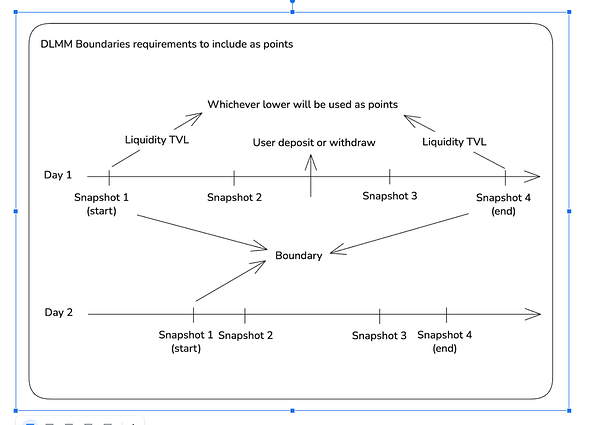

– Estimated points (TVL only): Based on the formula 1 TVL = 1 point/day, this should amount to at least ~18.25M points just from TVL.

– Actual points received (TVL only): ~5.2M points, which seems to represent only ~28% of what should be expected.

– Fees generated: I was also in a pool with at least 5% APY, meaning roughly $2.5k in fees, which should add an additional 2.5M points under the $1 fees = 1,000 points rule.

Total estimated points = over ~20M, while I only received about 5M.

I’ve even underestimated these figures on purpose to avoid overclaiming. So in reality, the actual expected number of points is likely even higher.

I understand there may be some cutoffs or eligibility rules, but considering this was long-term, consistent TVL in a core pool, I would really appreciate it if the data could be rechecked or if I could get a snapshot history of how the points were attributed over time.

Let me know if you need further information. Thanks a lot for your time and support.

Best regards,

Sash.