Our last update: We taken the snapshot for LP Stimulus Plan, Season #1, as of 30th June 2025, with Season 2 starting on 1st July.

Today’s Update: Points Checker for S1 is live, for both 2024 and 2025.

Check out your points here:

This checker is live across Hawkfi, Kamino, and Parallel Bot by Solport Tom.

Filtering out Fake Pools

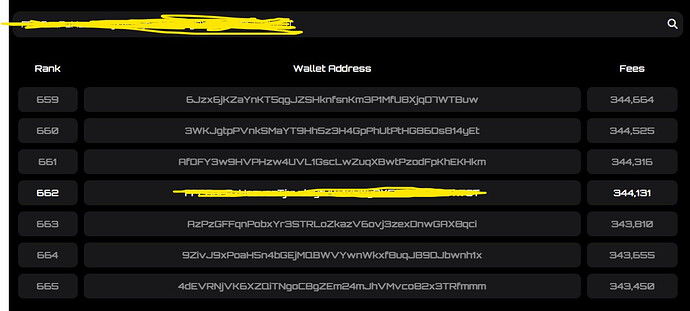

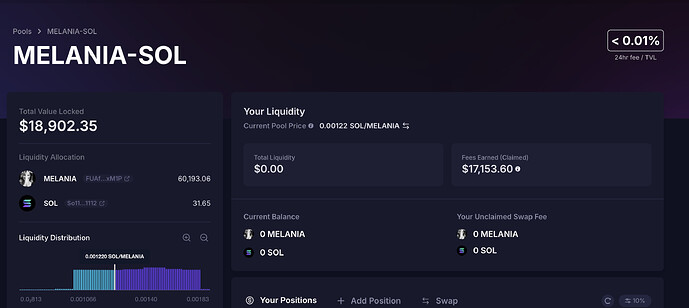

As per LP Stimulus Proposal, we distribute 1,000 points per $1 in trading fees, and 1 point per $1 of daily TVL.

Note: There are a lot of addresses that fall below the points cutoff for the $MET Airdrop. For these users, you may see a low points balance but no airdrop.

As part of the points checker, we did a lot of work to reduce as much suspicious activity as we can, to minimize wash trading or fake points leading to inflated points.

We used the global pool-based blacklist, supported by the community, the report-pool button you see on the UI. In addition to that, we also applied Wallet, Pool, and Token Based rules.

Wallet-based Blacklisting

We worked with Dethective and Arkham Insights to identify a list of 100+ Kelsier addresses, and zeroed all of them out. Notably they had a lot of points, both from deploying scam tokens or from extracting using DLMM.

In addition, Rugcheck.xyz provided a list of 30K+ addresses being marked as suspicious. If this is you, you should be able to submit an appeal on the UI.

We’ve taken a pass at the 30,000 addresses, and whitelisting those who pass our own internal criteria, this led to 2.5K addresses being whitelisted, many our most loyal power users.

We’ll continue to adapt to how to use this list, and your appeals will help us assess how to leverage this list better. Submit an appeal if you are flagged accordingly.

Appeals

We know we’ve caught a lot of retail users in the wallet-based blacklisting. We’ve opened an appeals page, for you to submit your appeals and inform us what happened to cause your wallets to be flagged by the system.

With this, we can adapt the usage of our usage of the list of flagged wallets, and filter as many retail users as possible. Rest assured that seeing the flag does not mean that your points are revoked, but we just need you to submit an appeal.

We will release results of appeals before TGE, either on the airdrop checker or on the points page.

Pools-based Blacklisting

For pools, we tried to identify as much pools as we can that was programmatically doing wash trading, to inflate their points.

To do this, we qualified pools daily (UTC time) based on some set criteria:

-

Jupiter Trade Count == If there is 10 swaps through Jupiter

-

TVL == >$500 USD

-

Volume == >$500 Volume

If a pool can’t have $500 TVL, they wont be on Jupiter, and without Jupiter trades we can identify that the pool had no retail counterparty, and fees are generated only by a small cluster of addresses.

For DAMM V2, we applied an additional criteria of calculating the closing base token and quote token amount and comparing them. If the base and quote tokens were off by a factor of 10 (means that the pool saw an imbalance of more than 10x), we filtered the pool out for the day.

This had the effort of removing pools that saw significant turn-over (prices moving up and down 10x with low liquidity), that was farming points.

However, a lot of pools passed these criteria and was still marked as wash trading. At one point, we identified more than 3 billion dollars worth of fees in 2025, which showed that something was wrong.

We moved to Tokens based Blacklisting.

If a Token authority == Position Owner of the DLMM Position, we blacklisted the token and any pools created with that token. For example, if you minted a token, and then provided liquidity on it, that token and its fees will be blacklisted.

We also applied a list of generic rules:

-

Top 2 holder count > 98%

-

Top 5 Holders >+ 95%

-

Freeze Authority == true

-

Token Holder Count <= 100 → blacklisted

These tokens are highly suspicious and was blacklisted, with the except of Jupiter Verified Tokens, making tokens like USDT which have freeze authority immune to this restriction.

Prices

Prices were difficult. We knew that we needed a solution that could accurately track prices, since a lot of fees were generated on memecoins which regularly see large movements.

For DLMM: We settled on Allium’s Closing Price, taking the last closing price (Candle) of the day, so at UTC 00:00. They have their own proprietary price calculations, here: https://docs.allium.so/historical-data/prices/dex-token-prices-hourly#methodology

For DAMM V2: We used Allium’s hourly price, leveraging median_safe_price, median_price and price, and applying quantile distribution to remove spikes. This has the purpose of smoothening prices out for use.

That’s it – that’s how we calculated your points.

See you next round – Soju.